Program Overview

The Master of Finance – Beijing program is a STEM-intensive program that equips students with the advanced analytical, quantitative, and technological skills essential for success in the modern finance. With a strong emphasis on data-driven decision-making, financial modeling, risk management, and strategic leadership, the program integrates cutting-edge financial theories with real-world applications.

Program Structure

The International section is delivered in English and is designed to prepare you for a career in finance or to continue on to a PhD in a relevant area of study.

The Executive section is designed for senior Chinese business executives to augment their knowledge and experience, and is delivered in Chinese. It provides practical insights and learnings that can be applied to day-to-day workplace challenges. Graduates of this premier China-based western finance program stand out among their peers.

All classes are held on weekends with a few exceptions on weekday evenings.

Students must obtain an overall average grade of B (3.0) or higher, and must successfully pass all 10 courses to earn the Master of Finance degree from Queen's University.

Experiential Learning

Experiential learning, or “learning by doing” is one of the most effective ways to learn. Students in Smith’s Master of Finance program not only master the theoretical concepts, but learn how to apply these concepts to real-life opportunities.

Conferences, Workshops and Seminars

- The Guangdong-HK-Macau Great Bay Area Financial Forum

- The Marquee Group Financial Modeling Workshop

- Financial Career in Asia Workshop Series

- Financial Industry in China Workshop Series

- Corporate Visit Programs

Clubs

- Queen’s University Alternative Assets Fund

- Class Executive

- SmithConnect China Chapter

Database Resources

- Bloomberg

- Capitol IQ

- Online CFA Preparation Program

The Guangdong-HK-Macau Great Bay Area Financial Forum

The GDP of China's Great Bay Area surpassed the GDP of Canada as a whole in 2020. As a Master of Finance – Beijing student, you will have the opportunity to participate in the Guangdong-HK-Macau (The Great Bay Area) Financial Forum and visit one of the world's newest economics. The forum featured over 500 political and business leaders and academics from around the world.

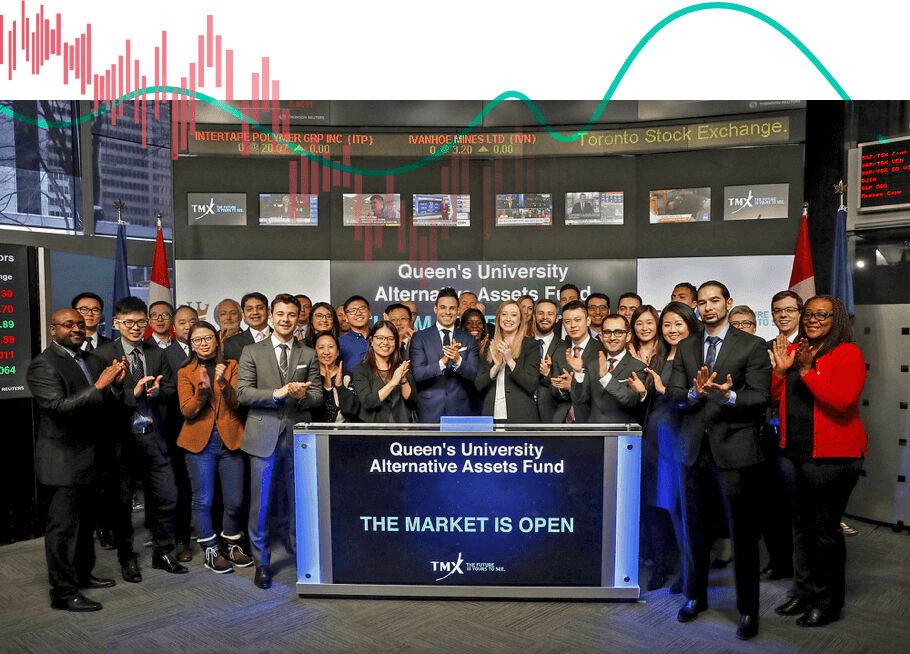

Queen's University Alternative Assets Fund

QUAAF is the only student-run hedge fund in North America and was the brainchild of four master’s students at Smith School of Business. Through QUAAF, students can analyze investment opportunities, commit real money, and monitor performance. The QUAAF management group includes Master of Finance and Master of Business Administration students, supported by an advisory committee of industry professionals. The fund has been seeded with contributions from alumni and friends of Queen’s University, and all proceeds contribute to the maintenance and expansion of the fund.

Learn more about QUAAF

“The MFin program served as a platform for me to make a smooth transition from my legal background into the financial industry. I was impressed with the passionate teaching of the faculty members who always pushed us beyond our limits and prepared us to tackle the challenges of the industry today.”

Shannon Gong, MFin

Associate, ESG

BCI

Victoria, BC

Partnerships

Smith's Master of Finance is a proud partner of the CFA Institute (Chartered Financial Analyst) and the CAIA (Chartered Alternative Investment Analyst Association).

CFA Partner

The Chartered Financial Analyst charter is the gold standard for investment practice, demonstrating expertise, experience, current practice, timeless investment principles, and a commitment to exemplary ethical standards. CFA Program Partner status is awarded to high profile universities of global stature that embed a significant percentage of the CFA Program Candidate Body of KnowledgeTM (CBOKTM) into their degree programs.

CAIA Academic Partner

The CAIA Charter is the educational benchmark for the alternative investment industry, which includes hedge funds, commodities and managed futures, private equity, credit derivatives and real estate. The CAIA Association® academic partnerships are awarded to accredited academic institutions whose curriculum covers a significant portion of the subject matter addressed in the CAIA program.

MFin - Beijing Milestones

2013

Initial MOE Approval

Master of Finance - Beijing was approved by China’s Ministry of Education (MOE), initiating a significant educational collaboration between Canada and China.

2014

The Inaugural Class

The pioneering class of 17 students began their academic journey on the campus of Renmin University in September 2014, setting a precedent of globally oriented educational experience for future classes.

2015

QUAAF Beijing

The establishment of the Queen’s University Alternative Assets Fund (QUAAF) Beijing team enriched the program offering with a unique opportunity to apply theoretical knowledge in real-world market scenarios.

2017

Executive Section

42 students with advanced leadership and financial expertise joined the very first Executive Section in September 2017.

2018

Smith Alumni China Chapter

The official launch of the Smith Alumni China Chapter enhanced Smith’s global alumni network.

1st MOE Renewal

The program’s accreditation was renewed by the Ministry of Education (MOE) in China, affirming a commitment to quality education.

2019

Expanded Career Services in China

In addition to the Smith Career Advancement Centre, the program has expanded its career services for students by incorporating local career coaching providers in China.

Program Size Over 100 Students

The program welcomed 105 students in September 2019, distributing them across two distinguished tracks: the International Section and the Executive Section, marking significant growth in enrollment.

2020

Swift Transition During Pandemic

The Master of Finance - Beijing swiftly transitioned to remote learning amidst the pandemic, adopting measures to ensure seamless continuity and robust online student engagement.

2021 & 2023

2nd and 3rd MOE Renewals

The program’s dedication to excellence was recognized with the second and third renewals by the Ministry of Education (MOE) in China, a testament to our enduring impact.

2024

Decade of Excellence

2024 marks ten years of transformative education delivered by the Master of Finance - Beijing. It is a year for reflecting on collective achievements and looking forward to future successes.