Out-Stocking Your Competitor

When it comes to products with a short shelf life, replenishing your inventory by instinct alone makes you easy pickings. Time to build your analytics toolkit

Firms that sell seasonal, perishable, or fashionable items are challenged to predict just how much stock should be carried at any one time. Some firms rely on instinct and on-the-ground judgment while others incorporate analytics based on hard data. A study by Anton Ovchinnikov, working with Brent Moritz and Bernardo Quiroga from Penn State Smeal College of Business, looks at how these two stocking strategies interact in a competitive environment. In a lab experiment, they found that “behavioural players” relying on instinct made the same inventory stocking errors whether they were operating in a competitive setting or not. They simply ignored what their competitors were doing. The “knowledgeable players” using analytics were able to take advantage of these predictable stocking errors of their competitors; as a result, they earned more profits and gained higher market share. As Ovchinnikov notes, some of the most sophisticated retailers are now combining both Big Data and on-the-ground intelligence in their decision-making mix. Ovchinnikov teaches in the Smith School of Business Master of Management Analytics program.

If you’re in the business of selling seasonal, perishable, or highly fashionable items, predicting just how much stock you’ll need on any given day or season is one of your biggest challenges. If you load up on swimsuits and there are shark sightings at the beach, your bottom line takes a hit. Order too few during an endless summer and lose customers to the swimwear joint down the road.

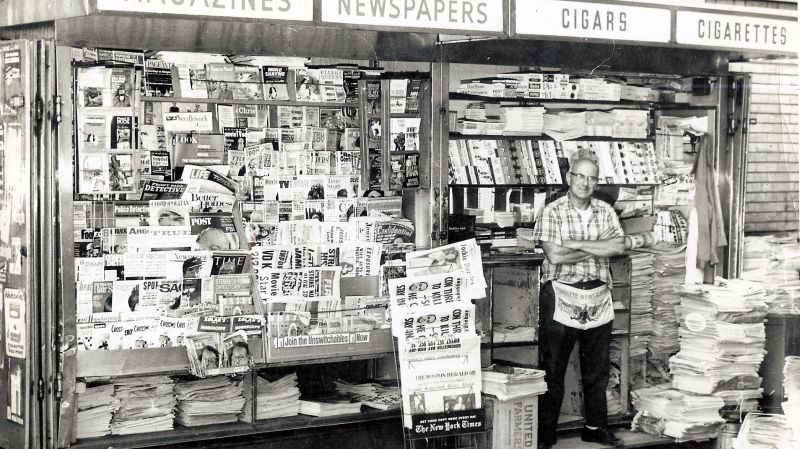

Such is the so-called “newsvendor’s dilemma,” named for the classic challenge faced by newsstand owners of deciding how many papers to order for the coming day.

Savvy retailers can use the newsvendor’s dilemma to their advantage. Anton Ovchinnikov, associate professor of management science and operations management at Smith School of Business, shares a story told to him and his research colleagues by the CEO of a large U.S.-based apparel retailer.

As the story goes, in the wake of the financial crisis in 2008, the retailer's managers based inventory decisions partly on how they thought competitors would behave. They figured that competitors, anticipating lower consumer spending, would reduce their inventory of higher-priced and better-quality “fabulous” garments and stock more lower-priced items. The retailer, however, bet that consumers, depressed by the financial crisis, would reduce the total number of clothing items purchased but favour the fabulous garments in order to brighten their spirits. So its managers stocked up on bigger-ticket items, Ovchinnikov says, and their bet paid off: the retailer was able to capture a larger share of demand and generate higher sales and profitability.

Behaviour in a Competitive Setting

Many studies have looked at how to optimize inventory decisions and forecast demand but none have really accounted for the behavioural factors of how firms operating in a newsvendor environment adjust their decisions in a competitive setting. A study by Ovchinnikov, working with Brent Moritz and Bernardo Quiroga from Penn State Smeal College of Business, aims to fill that gap.

The study, recently published in one of the leading academic journals, Production and Operations Management, is based on lab experiments and an analytical model. Subjects were divided into two groups. The “behavioural players” acted in the role of inventory managers in a typical retail operation who relied on intuition rather than a robust model to support their decisions. The “knowledgeable players” were more sophisticated managers who deployed management science to exploit the predictable irrationality of their competitors.

The researchers wanted to determine the ordering regularities of behavioural players in the face of competition, how knowledgeable players should best respond to them, and how such decisions would translate into profits.

They tested their subjects based on a number of common inventory restocking behaviours. Demand chasing, for example, is when inventory orders are increased or decreased in step with prior demand. “Asymmetric reaction” to under-stocked units is a tendency to overcompensate by placing larger orders after a stock-out.

Sophisticated Vendors Are Rewarded

What the researchers observed was good news for the more sophisticated vendors. They found that behavioural players made the same inventory stocking errors whether they were operating in a competitive setting or not. These individuals simply ignored the stocking decisions of their competitors. As a result, the knowledgeable players were able to earn more profits and gain higher market share by exploiting the predictable behaviours of the behavioural player.

“Is accounting for this behavioural phenomenon really worth it?” asks Ovchinnikov. “We show that it is.”

Ovchinnikov says a take-away for knowledgeable “newsvendors” is that they should carefully track their competitor’s stock-outs and adjust their orders accordingly without worrying about how the competitor will respond. For example, if they know that their behavioural competitor tends to place disproportionately large orders after stock runs out, Ovchinnikov says, “that means I will not have as much overflow from them so I can adjust the quantity that I need to order.”

In a competitive setting, inefficiencies in stock ordering can lead to a big hit on the bottom line, on the order of 20 to 70 percent

What about firms that rely on store managers or fashion buyers to guide inventory decisions for their seasonal, perishable, or fashionable items: should they invest in automated systems? Ovchinnikov says that if they have absolutely no competitors, it may not be worth it.

“They may be making an inventory mistake of typically 10 to 20 percent, but the profit implication of that is super small,” he says. “A 10 percent mistake typically is less than one percent of profit and a 20 percent mistake is about four percent of profit.” Executives may feel it is not worth micromanaging their inventory managers for such small returns.

But additional research by Ovchinnikov and colleagues shows that in a competitive setting, such inefficiencies in stock ordering lead to a much bigger hit on the bottom line, on the order of 20 to 70 percent. That’s because more sophisticated competitors can easily take advantage of behavioural buyers.

Gut instinct does have its place in procurement operations. In fact, some of the most sophisticated vendors combine Big Data and intuition. As an example, Ovchinnikov points to Spanish apparel retailer Zara. “They are combining the expertise of the managers on the ground who have intangible information about what people like or don’t like with what their data system believes they should be doing.”

— Alan Morantz