Curriculum

The MFIN curriculum is designed to integrate financial theory with real-world application, equipping students with the analytical and technical capabilities required to succeed in a fast-paced and evolving global finance industry. The program begins with a strong quantitative foundation, including statistics and AI-assisted Python programming applied to finance-specific use cases. Building on this foundation, students study financial markets and macroeconomics, corporate finance and financial modeling, before progressing to fixed income markets, portfolio management, derivatives, and hedge fund strategies. A range of electives enables further specialization in areas such as private equity, investment banking, and sustainable finance.

Core Courses

Whether we like it or not, as individuals and managers we evolve within various markets, and are subject to their rules. But how do world events shape our markets, decisions, and outcome predictions? This is the question we will address in our first theme, "Understanding Markets".

These markets are themselves part of the economy as a whole – Canadian and global. This economy goes through booms and busts over time – the business cycle – and these fluctuations have an important impact on prices, national output, unemployment, and indeed affect our daily lives. In our second theme, "Understanding the Economy", we will learn the tools necessary to understand business cycles and governments’ policy responses; and to form educated opinions about what we read on the subject in the news.

But beyond understanding markets and the economy, today’s managers face a myriad of economic issues when formulating strategies. Should we enter this market? Should we exit that one? What price should we charge? How much should we produce? Should we try and “deter” entry by a rival, or should we “accommodate”? In some markets – monopolistic markets – our ability to affect outcomes is strong. How can we use this market power to our advantage? Other markets are characterized by the fact that our actions affect, and are affected by, rivals’ actions and require a whole new set of tools – game theoretic tools. How can we use game theory to analyze these situations? These and other fundamental questions are addressed in our third theme, "Decision-Making in Market Environments".

The primary pedagogical objectives of the course are for students a) to familiarize themselves with important economic concepts, and b) to learn to use them as “tools” for efficient decision-making in business and other environments.

This course is an intensive, practice-oriented program focused on industry best practices in financial modeling. Participants develop the skills required to build well-designed, transparent, and dynamic financial models used in valuation, transactions, and strategic decision-making. The course covers model design, logical structure, construction techniques, core financial concepts, and appropriate accounting treatment. Key topics include building integrated financial statements, developing depreciation and tax schedules, forecasting and modeling working capital and capital structure, and performing discounted cash flow analysis. The course provides an essential foundation for students interested in corporate finance and investment banking.

MFIN 821 introduces students to the basics of corporate finance including: an overview of the financial system; a discussion of the importance of business ethics and corporate governance; a review of financial statement analysis; financial forecasting; bond and equity valuation; an introduction to risk management and portfolio theory; the Capital Asset Pricing Model (CAPM); how to determine a company’s overall cost of capital; and, a detailed discussion of capital budgeting decisions. The emphasis will be on applying the concepts to real-world situations using actual market and company data to examine company decisions and assess their future growth prospects and risks.

This course will provide students a comprehensive overview of the fixed income markets, the main debt instruments traded, types of issuers and investors, and practices in the industry. Our main focus is on the cash debt markets, with coverage of derivatives to enhance analytic tools in the subject, and on risk-management. Our goal is to bridge the gap between theory and practice by illustrating how models and theories inform best trading and risk management practices in the fixed-income space.

Course Goals:

- Linking bond theory with practice – use of market simulations and ‘mini’ cases in class to demonstrate and apply theory to real market instruments

- Building knowledge of current fixed income markets and issues

- Building bond portfolios – ability to incorporate yield curve, credit, capital structure and other variables into a comprehensive approach to fixed income portfolio management

- Understanding of bond mathematics, bond pricing and relative value of product across the credit spectrum

This course explores the theoretical and empirical evidence relevant for investing and portfolio management. We will focus on traditional assets (equity and fixed income) as well as alternative assets (e.g. commodities, real estate, private equity, venture capital) and investment style (carry, momentum, value). We will learn how to combine these assets and strategies into portfolios to achieve specific investment objectives. While the course is designed to meet the needs of students who might want to pursue a career in the investment field, the course will prove useful for personal investing as well.

This course provides a comprehensive overview of derivatives and the markets in which they are traded. We implement the manufacturing process underpinning linear as well as non-linear instruments and, in this process, uncover the key relationships employed by market participants to value them. Furthermore, we explore how derivatives are used by financial institutions, as well as by non-financial firms, to manage unwanted risk exposures and/or to enhance investment yields. The course covers plain-vanilla derivatives (e.g. futures, forwards, FRAs, swaps, and options) as well as more recent innovations, such as exotic options and credit derivatives. We also explore best practices in enterprise-wide market and credit risk management, as well as recent developments in the regulatory environment surrounding the derivatives marketplace.

This course provides a high-level quantitative examination of the strategies employed by modern hedge funds. Moving beyond qualitative surveys, the course “opens the black box” of alpha generation by focusing on mathematical frameworks, econometric modeling, and the algorithmic implementation of specific trading styles. Students will analyze the mechanics of risk premia, market neutral strategies, and arbitrage opportunities through the lens of institutional-grade execution, emphasizing the transition from theoretical pricing to active portfolio management. This course provides students with the tools to engineer complex structured products and manage multi-manager portfolios in a high-conviction environment.

This course prepares students with the concepts and programming tools required to analyze financial data encountered in professional finance practice. The course introduces the Python programming language and its ecosystem, including package management, numerical computing, data manipulation, and data visualization. All programming tasks are supported by an AI agent. The course also introduces key concepts in statistics and machine learning for the analysis of financial data. Students learn to implement and program in Python machine learning and time-series models that are commonly used in finance. The course features a highly interactive, project-based learning format using real-world cases, where statistical concepts are applied to specific financial use cases, including credit scores and default rates, stock prices and returns, and interest rate data.

Elective Courses

Students are required to choose one elective each term.

Fall Term Electives

The financial sector plays a critical role in our sustainable future since it is responsible for allocating funds to its most productive use. It is therefore well positioned to direct investments to sustainable corporations, organizations and projects, and assist in making strategic decisions on trade-offs among sustainable goals. By financing sustainable companies and endeavors, the finance sector can accelerate the transition.

Financial system participants, such as investors, have the power to exert their influence to drive sustainable business practices within companies that they invest in. Most importantly, finance can help certain sectors of the economy that are vulnerable to climate change shocks (i.e. transportation, insurance, reinsurance) in understanding and pricing risks associated with environmental issues. The Canadian Expert Panel report states that “Sustainable finance is both about building resilience to those widespread impacts and preventing further exacerbation.”

This intensive course will cover the major financial implications associated with climate change. Specifically, the course will examine the business opportunities and risks associated with climate change and sustainability. The structure and role of the major elements of the finance industry and finance policy, and the resulting shifts will be the major focus.

This course will provide students with a brief review of the key principles of risk and return, modern portfolio theory, and market efficiency, which are critical inputs into both the corporate finance decision-making framework (through their impact on the cost of capital) and equity analysis (through their impact on the equity discount rate). Topics will include among others: risk and return; modern portfolio theory; capital market equilibrium models (including CAPM); fundamental economic, industry, and company analysis. Equity analysis will include a detailed and application-focused discussion of valuation models including the dividend discount model, free cash models and relative valuation approaches.

In addition to class assignments that will involve the analysis of real-world companies, students will also prepare a thorough analysis of an actual company to give them an opportunity to apply the concepts learned during the course to a real-life situation, and to assist in preparing them for the Toronto CFA Investment Research Challenge Competition.

Winter Term Electives

Private equity plays an important role as an intermediary between investors and firms. Private equity funds are also an important investment alternative for institutional investors such as pension funds and sovereign wealth funds. The purpose of this class is to introduce students to private equity and provide them with practical tools that will help them understand, value and structure typical transactions in this sector. The course will introduce students to the spectrum of different types of private equity firms and transactions from investments by institutional investors to dedicated specialist firms. The focus will be on developing a familiarity with the types of transactions considered by private equity funds, how to structure these transactions and measure the value added to the portfolio firm. The lectures and case analyses will take students through the stages of PE investments from finding a target, to due diligence, deal pricing and structuring, ownership, and preparation for exit. The last part of the class will examine the historical risk-adjusted performance of private equity as an asset class relative to public markets.

This course is designed to provide an overview of investment banking. Key areas it will cover include: capital raising, valuation methodologies, mergers & acquisitions and an overview of other corporate restructurings such as leverage buyouts. Both private and public markets will be discussed, including private equity, within the current global context. Given the previous courses the students have already taken in the MFIN program, in-class cases will be an important part of illustrating selected investment banking topics.

Not all electives are available both remotely and in person, and they are subject to change given the demand for each topic in a given year.

Workshops

Compulsory

- Communication in Finance

Optional

- Merger Modeling

- Capital Structure (LBO) Modeling

Experiential Learning

Experiential learning, or “learning by doing” is one of the most effective ways to learn. Students in Smith’s Master of Finance program not only master the theoretical concepts, but learn how to apply these concepts to real-life opportunities.

Case Competitions

- CFA Research Challenge

- CFA Ethics Challenge

- Van Berkom Small Cap Case Competition

- National Investment Banking Competition

Clubs

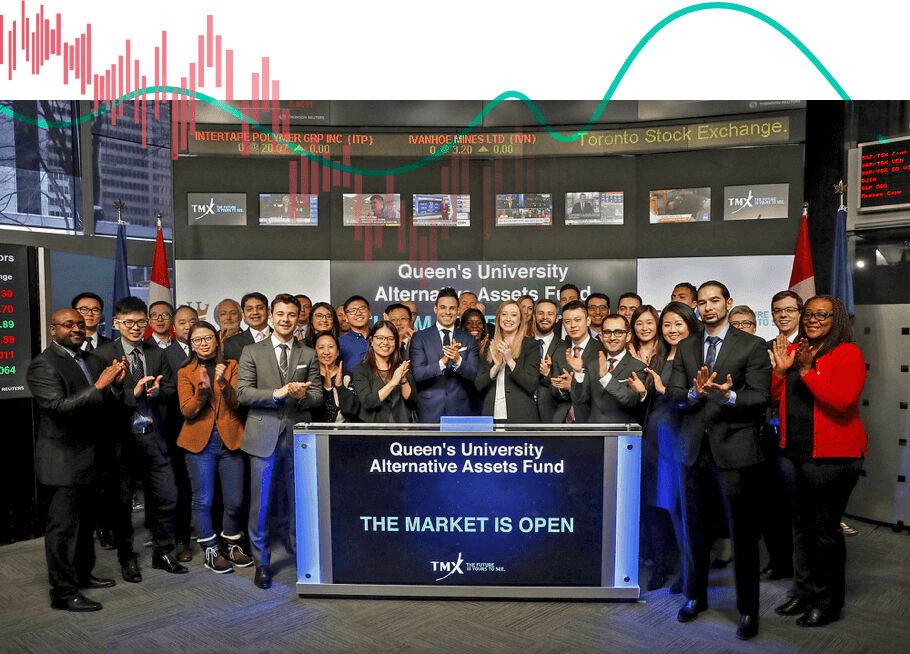

- Queen’s University Alternative Assets Fund

- Class Executive

- Smith Women in Finance

- MFin Gives Back

Queen's University Alternative Assets Fund

QUAAF is the only student run hedge fund in North America and was the brainchild of four Master's students at Smith School of Business. The student management group consists of a mix of MBA and Master of Finance students that comprise an Executive Committee and teams of Analysts. They are supported by an Advisory Committee of industry professionals. This fund has been seeded with contributions from alumni and friends of Queen's, and all proceeds contribute to the maintenance and expansion of the fund.

Learn more about QUAAFCFA Institute Research Challenge

As a Master of Finance student, you will have the opportunity to participate in the CFA Institute Research Challenge. This is a competition between university-sponsored teams that involves researching a designated publicly traded company, preparing a written report on that company and presenting your findings to a panel of judges. Competition takes place at the national, regional and global level.

“QUAAF allows students to take leadership roles in a capital markets’ environment. As a team, we’d meet weekly, do a market update, and then review our portfolios. As leaders of QUAAF, we were required to take a firm view of the financial markets and speak about them fluently. We were investing real money, so we had to do real research. When I came in as CEO, I wanted to ensure there was a process around everything. I used what we were doing as part of the CFA Research Challenge and brought it to QUAAF.”

Fixed Income Credit Analyst

AGF Investments Inc.

Partnerships

Smith's Master of Finance is a proud partner of the CFA Institute (Chartered Financial Analyst) and the CAIA (Chartered Alternative Investment Analyst Association).

CFA Partner

The Chartered Financial Analyst charter is the gold standard for investment practice, demonstrating expertise, experience, current practice, timeless investment principles, and a commitment to exemplary ethical standards. CFA Program Partner status is awarded to high profile universities of global stature that embed a significant percentage of the CFA Program Candidate Body of KnowledgeTM (CBOKTM) into their degree programs.

CAIA Academic Partner

The CAIA Charter is the educational benchmark for the alternative investment industry, which includes hedge funds, commodities and managed futures, private equity, credit derivatives and real estate. The CAIA Association® academic partnerships are awarded to accredited academic institutions whose curriculum covers a significant portion of the subject matter addressed in the CAIA program.