A Guide to Corporate Distress and Credit Markets in COVID-19

For financial and investment professionals, there’s never been a time like now

COVID-19 has upended businesses around the world, forcing many into bankruptcy or to the brink of it.

But what are the true trends in leveraged finance markets and bankruptcy? What can we expect ahead? And are government efforts helping or hurting long-term?

This 60-minute webinar features an all-star panel of experts: Edward Altman (professor emeritus at Stern School of Business and inventor of the famed Z-Score bankruptcy predictor), Edith Hotchkiss (professor at Boston College), Wei Wang (professor at Smith School of Business) and Yong Wang (chief risk officer at Tianfeng Securities of China). It explores corporate distress and bankruptcy during the pandemic, and the impact on global markets.

This webinar was recorded on Thursday, March 25 at 9 a.m. EDT.

Participants learn:

• How the pandemic has affected bankruptcy rates

• Expected trends in 2021

• Major challenges faced by distressed companies around the world

• The role of government policies: Have they helped firms or just kicked problems down the road?

• The long view: Will the current bankruptcy trend and restructuring activities continue even in the coming years?

This webinar is of strong interest to financial and investment professionals, and corporate leaders. Following the presentation, there is a Q&A with our speakers.

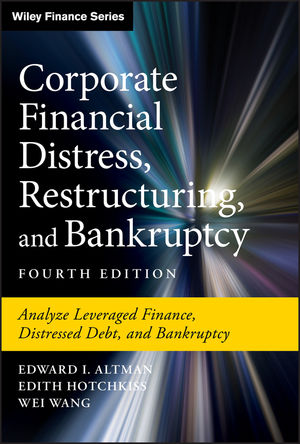

Corporate Financial Distress, Restructuring, and Bankruptcy, Fourth Edition

Edward Altman, Edith Hotchkiss and Wei Wang are co-authors of the fourth edition of Corporate Financial Distress, Restructuring, and Bankruptcy. An authoritative book on finance, this edition updates and expands its discussion of financial distress and bankruptcy, as well as the related topics dealing with leveraged finance, high-yield and distressed debt markets. It offers state-of-the-art analysis and research on U.S. and international restructurings, applications of distress prediction models in financial and managerial markets, bankruptcy costs, restructuring outcomes and more. Yong Wang is the chief translator of the recently published Chinese edition of the book.

Session Participants

Dr. Edward Altman

Professor Altman is an internationally renowned expert on corporate bankruptcy, high-yield bonds, distressed debt and credit risk analysis. He is the creator of the world-famous Altman Z-Score models for corporate bankruptcy prediction and was named one of the “100 Most Influential People in Finance” by Treasury & Risk Management magazine. He is frequently quoted in the press and is an adviser to many financial institutions.

Dr. Edith S. Hotchkiss

Professor Hotchkiss studies corporate financial distress and restructuring, the efficiency of Chapter 11 bankruptcy, and trading in corporate debt markets. Her work has been published in leading financial journals, and she has served as an adviser in several recent Chapter 11 cases. Before her academic career, she worked in consulting and for the financial institutions group of Standard & Poor’s.

Dr. Wei Wang

Professor Wang is an expert on corporate restructuring, bankruptcy, distressed investing, leveraged finance and high-yield bonds. His research has been published in top finance journals and featured in the Wall Street Journal, Dow Jones Newswires and other prominent media. He has taught at Wharton and the Hong Kong University of Science and Technology Business School. He is the co-author of the authoritative finance book “Corporate Financial Distress, Restructuring, and Bankruptcy (Fourth Edition)”. Prior to his academic career, he worked in commodity derivative trading and financial engineering.

Dr. Yong Wang

Yong Wang is chief risk officer and chief information officer at Tienfeng Securities, a leading investment bank in China. Before joining Tienfeng, he was the CRO of Everbright Securities and a managing director at Royal Bank of Canada. He has written two books and translated numerous others in the fields of risk management, fintech and financial derivatives.