Sustainable Debt

What are the Different Categories of Sustainable Debt?

Currently, the largest category of sustainable debt is green bonds. These are designed to raise funds to invest in environmental or climate change mitigation projects. Green bond issuers commit to provide investors with detailed on-going information on the projects and infrastructure supported with the green bond proceeds, as discussed in the ISF’s Green Bonds primer.

ISF Primer Video Series

Understanding a booming Sustainable Debt market, with Sarah Thompson

“What’s exciting is … there are opportunities for all types of issuers to enter the market.” ISF Chair Sean Cleary interviews Sarah Thompson, Managing Director, Sustainable Finance Group, RBC Capital Markets, about the kinds of sustainable debt that are out there, how the market is growing, and how to address concerns about “greenwashing.”

Transition bonds are debt issues where the proceeds are used to fund a firm’s transition towards a reduced environmental impact and/or to reduce their carbon emissions. The proceeds could be used exclusively to finance new and/or existing eligible transition projects, and the issuer would be required to commit to shifting to more sustainable business practices, as discussed in the ISF’s Transition Bonds primer.

Social and sustainability (S&S) bonds raise funds for projects with objectives that go beyond specific climate-related objectives. For example, the use of proceeds from sustainability bonds could include a combination of green and social projects or activities, while the proceeds from social bonds would be related to social objectives. S&S bonds are commonly linked to one of the Sustainable Development Goals (SDGs). The SDGs include several social goals such as: no poverty; gender equality; and, reduced inequalities (among others). The SDGs also include several environment-related goals such as: climate action; protecting life on land; and, conserving life below water (among others). Governments and government-backed entities are among the largest S&S bond issuers, generally comprising well over half of issues.

Sustainability-linked debt (SLD) instruments are those that have interest rates tied to the achievement of specific Key Performance Indicators (KPI) and/or sustainability performance targets (SPTs) at the issuer level.

What are Recent Developments in the Sustainable Debt Market?

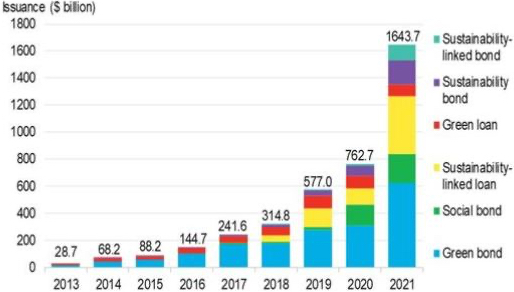

During 2021, there was $1.644-trillion US in sustainable debt instruments issued. This set a new annual record and brought total debt issuance to over $4-trillion US. Figure 1 shows that this market continues to grow rapidly as 2021 issuances represented more than double the 2020 issuances of $762.7-billion US.

Figure 1

Sustainable debt annual issuance

Source: Bloomberg 1H 2022 Sustainable Finance Market Outlook

Figure 1 also shows the amounts issued in several main categories during 2021:

- Green bonds: >$620-billion US

- Sustainability-linked bonds and loans: $530-billion US (more than four times the 2020 figure)

- Sustainability and social bonds: $400-billion US

The Climate Bonds Initiative (CBI) forecast that $1-trillion US in annual green bond issuance was within reach by 2023.1 During the summer of 2021, Moody’s forecast “sustainable bonds to account for around 8 percent-10 percent of global debt issuance in 2021, as issuers across all segments of the market continue to explore how they can link their capital markets activities with their sustainability objectives.”2 The report also noted continued growth in the sustainability-linked debt market as an emerging form of financing.

Sustainability-Linked Debt

As can be seen in the comments made by Moody’s and as reflected in Figure 1, sustainability-linked debt is a rapidly growing market segment. As noted in an October 2021 RBC report, issuing SLD debt provides greater flexibility than issuing green bonds, since the debt may be used for general corporate purposes.3 This has been a major factor that has driven growth in the segment, especially when combined with an increasing number of companies establishing and pursuing targets related to reduced greenhouse gas (GHG) emissions, as well as other important environmental, social and governance (ESG) objectives. The RBC report also notes that the development of voluntary process guidelines developed by various international loan market associations, as well as the International Capital Market Association (ICMA), has facilitated growth in this market.

- 1Source: Climate Bonds Initiative, Sustainable Debt Highlights H1 2021

- 2Source: ESG Today, July 21, 2001

- 3Source: BC Capital Markets, Sustainability-Linked Debt: Aligning Corporate & Financial Strategy, Oct. 29, 2021