Recognizing Research Excellence at Smith

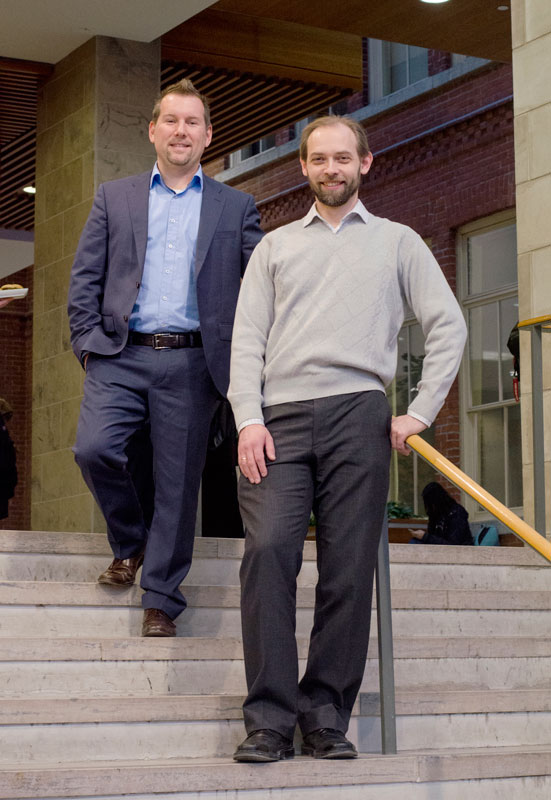

Mikhail Nediak, Associate Professor and Toller Family Fellow of Operations Management, received the Research Excellence Award. Ryan Riordan, Assistant Professor and Distinguished Faculty Fellow of Finance, was the recipient of the New Research Achievement Award.

The two were selected by an ad hoc committee of Smith scholars that annually assesses the achievements of the school’s researchers. In addition to the recognition, the honorees receive grants to support their research.

Mikhail Nediak

Since coming to Queen’s in 2004, Mikhail has made significant contributions in the areas of management science and operations. After completing undergraduate and MSc degrees at the Moscow Institute of Physics and Technology, he went on to complete his PhD in operations research at Rutgers University in New Jersey.

Most of Mikhail’s work, which has been published in journals such as Production and Operations Management and Operations Research, focuses on revenue management and dynamic pricing: essentially, how sophisticated analytics can be harnessed to predict consumer behaviour and to maximize revenue through product availability and price. “I want to help businesses be more profitable and consumers to better understand the dynamics of pricing,” he says. “I love discovering something that no one else has found and sharing it with others.”

Mikhail’s research with Smith colleagues Jeffrey McGill, Professor in Management Science/ Operations Management, and Tatsiana Levina, Associate Professor in Management Science, has been supported by NSERC Discovery grants. In 2013, Mikhail, along with Jeffrey and Yuri Levin, Chaired Professor of Operations Management, received the prestigious INFORMS Revenue Management and Pricing Practice Award.

Ryan Riordan

Ryan was in a farmhouse in Tuscany when word arrived that he had received the New Research Achievement Award. He and his wife uncorked a bottle of Prosecco to celebrate.

In a short period of time, Ryan has carved out a reputation as a leading scholar in the area of high-frequency trading (HFT), a controversial form of hyperfast trading that uses complicated algorithms to buy and sell stocks in milliseconds. He is also looking more broadly at whether or not faster price discovery is better for markets.

His work has attracted media coverage on CNBC, in The Globe and Mail, The New York Times, Financial Times, and The Wall Street Journal. He has received grants for this research from the Social Sciences and Humanities Research Council (SSHRC) and the Investment Industry Regulatory Organization of Canada.

In 2014, Ryan arrived at Smith after serving on the faculties of the University of Ontario Institute of Technology, and the Karlsruhe Institute of Technology in Germany, where he had obtained his PhD. Previously he had worked as a trader and risk manager at HSBC Trinkaus in Düsseldorf.

Ironically, early in his academic career, Ryan was advised to stay away from researching market microstructure (the underlying mechanisms of trading in financial markets). “People said microstructure was dead; no one gets hired in this area, nothing gets published, no one finds it interesting,” he says. “Well, I found it really interesting and couldn’t imagine other people wouldn’t find it interesting, too. It could have gone horribly wrong, but I was lucky.”