Tight Communities, Loose Lending

High social capital means a lower cost of loan capital

- Social capital is defined as a “good culture” that’s the product of both dense networks and altruistic norms, such as mutual trust, volunteerism, and philanthropy.

- According to a new study, firms located in regions that have high social capital receive lower-cost bank loans, while firms located in lower social capital regions experience a higher cost of bank loans.

- Banks are reacting to the anticipated behaviour of the lending firm, as implied by the societal-level social capital.

We know that communities with plenty of social capital — where people are widely connected and trust one another — are great places to live. Can they also be great places to headquarter a big business?

A recent study suggests this may be the case. The research establishes a link between firms located in areas of high societal-level social capital and the bank loan rates they receive.

"To the extent that private loans issued by banks represent an important source of corporate financing and that loan contracts are very costly, social capital can add great value to the society if it can reduce the cost of borrowing,” says Ning Zhang of Smith School of Business,

Zhang and his collaborators C. S. Agnes Cheng formerly of Hong Kong Polytechnic University, Jing Wang of Smith School of Business, and Sha Zhao of Oakland University, define social capital as a “good culture” that’s the product of both dense networks and altruistic norms, such as mutual trust, volunteerism, and philanthropy.

“Some research has shown that a strong network fosters a norm that is conducive to cooperation, and that cooperative norms facilitate these networks,” says Zhang. “We believe that the two components reinforce each other.”

Measuring Good Culture

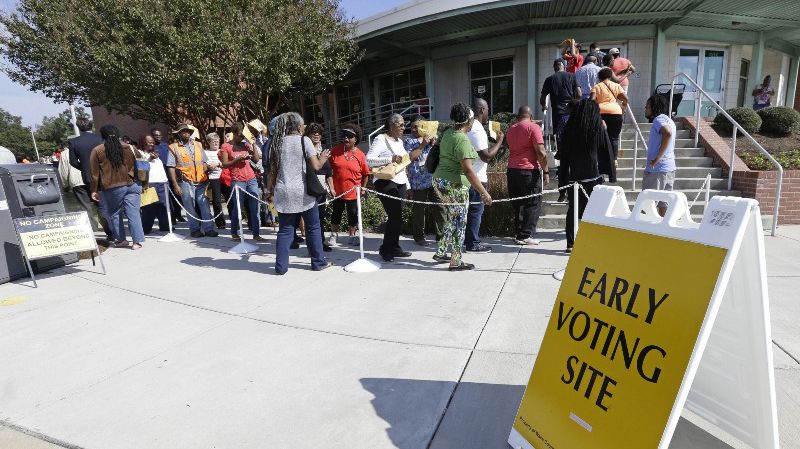

But how do you measure “good culture”? The researchers built a social capital index of U.S. counties that employed four key variables: voter turnout in presidential elections; census response rates; the number of social and civic associations; and the number of nongovernmental organizations. Firm loan spreads were used to measure the cost of bank loans.

Once these data points were combined and analyzed, the researchers found that firms in counties with higher societal-level social capital benefit from lower loan spreads. This finding was confirmed in two additional scenarios.

First, Zhang and colleagues analyzed a subsample of firms that experienced a change in societal-level social capital. Specifically, they looked at companies that relocated their headquarters due to state-level tax policy changes. They found that firms that move to higher social capital counties receive lower-cost bank loans, while firms that move to lower social capital counties experience a higher cost of bank loans.

A second scenario examined the impact of the terrorist attack in New York City and Washington D.C. on September 11, 2001. Following the attack, local governments took a number of actions that boosted social capital in the two affected states of New York and Virginia. The researchers found that firms located in these affected counties experienced significantly lower loan spreads than other firms after the attack.

Banks Heed Regional Signals

Zhang says that the cost of bank loans is being reduced via two factors that banks consider when determining the terms of a loan: the lending risk and information risk.

“Firms develop their corporate culture in such ways that they honour the implicit contract, they honour the social norms,” says Zhang. “The higher social capital actually motivates the lenders to charge lower loan spreads than are expected because, we hypothesize, the social mechanism provides a force to monitor the manager, to behave in ways such that they will utilize the borrowed funds appropriately.”

This behaviour reduces that bank’s lending risk, which is then compounded by the network component of the social capital. In a dense network, banks can verify firm-specific information from suppliers, customers, employees, and other stakeholders, and do so from people who are deemed to be more trustworthy, thereby reducing the information risk.

According to the study, which was published in the Journal of Accounting, Auditing and Finance, the banks are reacting to the anticipated behaviour of the firm.

The researchers note that several conditions, mainly alternative information sources about the lender, may moderate the impact of societal-level social capital. They found that a lender is more likely to assess default risk based on prior lending interactions and local information, such as local newspapers, when in close geographic proximity. The result is that the impact of social capital is more pronounced for firms that have no previous relation with the lenders and are geographically farther away.

Businesses do not operate in isolation from the world – or the society – around them, says Zhang. “The environment that you operate your company in shapes your corporate behaviours,” he says. “It starts externally but it will gradually internalize into some sort of good corporate culture. We believe the social force can provide some incentives for firm managers to consider the impacts of the social network and social norms when they go to borrow funds from banks.”

— Sparrow McGowan